Apa kesudahan nya dengan Rohingya? Mula-mula dulu, banyak negara termasuk Malaysia, Thailand dan Indonesia tak mahu terima....tetapi Nelayan dari Indonesia, Thailand dan Malaysia masih sudi membantu, setidak tidak nya memberikan bantuan makanan dan minuman.

Sekarang keadaan dah berubah...negara2 ini sudi membantu...Turki dari jauh pun sanggup datang!!

Maka di Malaysia timbul isu baru...nak tempatkan mereka-mereka ini di mana? Di Pulau Pinang? Kerajaan negeri tak mahu terlibat kerana mereka mempunyai sumber yang terhad dan juga lambakan pendatang sebegini memberi isyarat bahawa mereka di terima dengan tangan terbuka dan akan timbul lambakan seterusnya.

Tapi, cadangan menggunakan kemudahan PLKN tu amat bernas.....mungkin itu boleh menjadi penyelesaian jangka pendek dan sederhana.... saringan tetap perlu di buat...penyakit! masalah sosial lain nya! penjenayah yang turut ambil kesempatan. Di kala Malaysia sendiri di penuhi dengan isu pekerja dan pendatang tanpa izin.....serta akan berulang kah Pulau Bidong kedua.!!!!

Jadi, apa kesudahan nya???

Sekadar Menumpang Lalu .... nama saja cukup mengambarkan isu isu yang di bangkitkan.

Tuesday, May 26, 2015

Monday, May 18, 2015

ROHINGYA 3

Press Release: Save Rohingyas from the hands of the human traffickers and greedy exploiters

Thursday, 07 May 2015 08:20 - Last Updated Thursday, 07 May 2015 08:30

ARAKAN ROHINGYA NATIONAL ORGANISATION, ARAKAN, BURMA

Arakan Rohingya National Organisation expresses its strong concern at recent exhumation on

brutal camps in 1st and 4th May of dozens of bodies from mass gravesites near human traffickers'

southern Thailand. More such graves are believed to exist in the region.

Rohingya of Arakan have become desperate to take dangerous voyages to countries within the

region in search of safe shelters in particular. Since June 2012 deadly violence and genocidal

massacres in Arakan their exodus to Bangladesh, Thailand, Malaysia, Australia and other

countries have swelled to alarming proportion.

Thailand where they were pressured, starved and beaten to death by their captors to extort

ransom from their families and relatives in overseas. Some of the victims were sold to work as

labourers in fishing boats and farmlands. It is apprehended that hundreds of boat people are

currently held up in the sea by the smugglers. The trafficking gangs are understood to have link

It is a disappointment that the Rohingya issue was not discussed in the recent 26th ASEAN

Summit held between 26-28 April in Malaysia, although the issue is a regional issue since bulk

of refugees had fled to Malaysia, Thailand and Indonesia. The Burmese/Myanmar government

is manifestly involved in the human trafficking as its security forces and repressive functionaries

have been forcing Rohingyas to leave their hearth and home while extorting money.

We appreciate the Thai Prime Minister’s recent statement and words of warning to get rid of the

human traffickers, to unearth their hideouts and victims’ graves, and to bring the culprits to

justice. In this connection, it is important that all countries in the region, including Bangladesh,

should strengthen cooperation in fighting against human trafficking and smuggling while

ensuring the protection of victims.

1. UN should constitute a Commission of Inquiry to find out the exact number of death of the

trafficked people and extent of their sufferings, and to bring the culprits to justice.

2. Concerted efforts through enhanced cooperation among the countries in the region -

including Bangladesh, Thailand, Malaysia, Indonesia and Australia - and with UN Bodies, such

as IOM in order to wipe out human trafficking and smuggling while protecting the

3. Burmese/Myanmar government is to be held responsible in human trafficking for its

Rohingya extermination policies and for compelling the Rohingyas to leave their hearth and

home.

4. ASEAN should discuss the Rohingya issue dynamically for a regional solution.

----------------------------------------------------------------------------------------------------------

ROHINGYA 2

Why are so many Rohingya migrants stranded at sea?

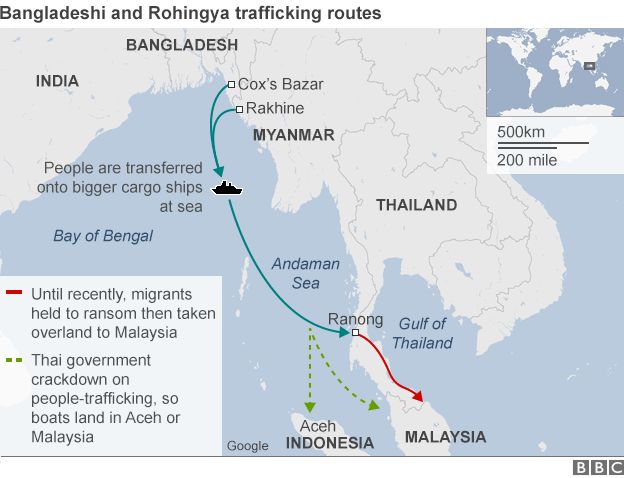

The Rohingyas - a distinct Muslim ethnic group who are effectively stateless - have been fleeing Myanmar for decades. But a combination of factors means many are now stranded in rickety boats off the coasts of Thailand, Malaysia and Indonesia with dwindling supplies of food and water.

Also on the boats are thousands of economic migrants from Bangladesh fleeing grinding poverty at home. Why are the Rohingyas fleeing Myanmar?

While the Rohingyas say they are descendants of Arab traders who have been in the region for generations, Myanmar's governments say they are not a genuine ethnic group but are actually Bengali migrants. Successive Myanmar governments have been introducing policies to repress the Rohingya since the 1970s, according to Burmese Rohingya Organisation UK (Brouk).

They are denied basic services and their movements are severely restricted. The repression of the Rohingyas has gradually intensified since the process of reforms introduced by President Thein Sein in 2011, Brouk says. In June and October 2012 there were large scale attacks on Rohingyas in Rakhine State following the gang rape of a Buddhist woman.

In addition, the government in March revoked temporary registration certificates issued to hundreds of thousands of Rohingyas, meaning they can no longer vote.

In the past three years, more than 120,000 Rohingyas have boarded ships to flee abroad, according to the UN refugee agency. It says 25,000 migrants left Myanmar and Bangladesh in the first quarter of this year, about double the number over the same period last year. Between 40-60% of the 25,000 are thought to originate from Myanmar's western state of Rakhine.

Why are stranded at the sea?

As many as 8,000 migrants from Bangladesh and Myanmar are believed by the International Organization for Migration (IOM) to be stranded at sea.

The Thai government has recently begun to crack down on smugglers who have traditionally taken them to camps in southern Thailand and effectively held them ransom. As a result the smugglers are now reportedly abandoning them at sea. Not only are countries in the region unwilling to let them land, fishermen are being told not to save them.

Who are the Rohingyas?

- Rohingyas are a distinct, Muslim ethnic group mainly living in Myanmar

- Thought to be descended from Muslim traders who settled there more than 1,000 years ago

- Also live in Bangladesh, Saudi Arabia and Pakistan

- In Myanmar, they are subjected to forced labour, have no land rights, and are heavily restricted

- In Bangladesh many are also desperately poor, with no documents or job prospects

What is the attitude to Rohingyas among countries of the region?

"Extremely unwelcoming," says Chris Lewa of the Rohingya activist group Arakan Project. "Unlike European countries - who at least make an effort to stop North African migrants from drowning in the Mediterranean - Myanmar's neighbours are reluctant to provide any assistance.- Thailand: Its navy says that it has given aid to migrant boats in its waters and has indicated it may allow refugee camps on its shores. But it is turning boats away and does not want permanent settlers.

- Malaysia: This is the choice of destination for most Rohingya travellers because it is predominantly Muslim and short of unskilled labourers. But Malaysia has ordered its navy to repel them.

- Bangladesh: Sometimes allows them to live in camps on its south-eastern border and sometimes sends them back to Myanmar. It is estimated there are currently about 200,000 Rohingyas living in refugee camps, many in squalid conditions.

- Indonesia: Has made it clear they are not welcome, turning away boatloads of migrants. It has accepted those rescued by fishermen but has warned them not to rescue any more. A group of migrants who made it ashore in early May may be expelled, the government has warned.

Can the Rohingya problem be resolved?

"Not until or unless the international community puts pressure on Myanmar to improve the lives of the Rohingya community," Chris Lewa argues, "because ultimately it is only Burma who can solve the problem."(source : BBC News : 18/05/15 at http://www.bbc.com/news/world-asia-32740637)

ROHINGYA 1

Why No One Wants The Rohingyas

An estimated 6,000 or more such migrants are stranded at sea in Southeast Asia. Most of the people on the overcrowded and unseaworthy boats are thought to belong to the 1.3 million-strong Rohingya minority in Buddhist-majority Myanmar. Others are believed to be from Bangladesh.

Reuters reports that while nearly 800 migrants on one boat were brought ashore Friday in Indonesia, other boats crammed full of people were turned away.

Such refusals underline "the hardening of Southeast Asia governments' stance on the boatloads of Rohingya Muslims fleeing persecution in Myanmar," Reuters says. The Rohingya practice a blend of Sunni and Sufi Islam.

'No Stomach' For Migrants

At best, the migrants have been received with resignation — at worst with contempt — even by the region's Muslim nations. As we've reported recently, many are victims of human traffickers.

The Thai and Malaysian navies have both turned away refugee boats in recent days. Indonesia has taken in some migrants but is now refusing to accept them.

Predominantly Buddhist Thailand has been battling an Islamist insurgency in its south for decades and has "no stomach" for bringing in more Muslims, says Lex Rieffel, a nonresident senior fellow and expert on Southeast Asia at the Brookings Institution

In any case, the country has a long history of dealing with unwanted migrants fleeing conflict in Cambodia and has no desire to repeat that, Rieffel says.

"If they break the law and land in Thailand, how can we take care of them?" Thai Prime Minister Prayuth Chan-ocha told reporters Thursday. "Where will the budget come from? That money will need to come from Thai people's taxes, right?"

For Indonesia and Malaysia, both Muslim-majority countries, the issue is less clear-cut, Rieffel says, but they are also interested in avoiding the appearance that they are opening the gates.

"We will try to prevent them from entering our territory, otherwise it will create social issues," Reuters quotes Indonesia's military chief Gen. Moeldoko as telling reporters. "If we open up access, there will be an exodus here."

"What do you expect us to do?" Malaysian Deputy Home Minister Wan Junaidi Jafaar was quoted by The Guardian as saying. "We have been very nice to the people who broke into our border. We have treated them humanely, but they cannot be flooding our shores like this."

Michael Buehler, a lecturer in comparative politics at the School of Oriental and African Studies at the University of London, points out that Indonesia has taken in several hundred Rohingya migrants in Aceh Province. Even so, Indonesia — like Thailand and Malaysia — also fears "an uncontrolled influx."

'A Horrible Mess'

Australia, which has dealt with its own influx of economic migrants fleeing Indonesia, says it is providing millions of dollars in urgent humanitarian aid to help cope with the problem.

"There are no easy answers on any aspect of this horrible mess," Rieffel says.

The United States, for its part, has called on regional governments to work together to save lives, but State Department spokesman Jeff Rathke stresses: "This is a regional issue. It needs a regional solution in short order."

Comment by David Kimball

The article states "State Department spokesman Jeff Rathke stresses: "This is a regional issue. It needs a regional solution in short order.""

WRONG. The flowing of thousands of refugees and/or undocumented immigrants is a Global Issue. It is a primary issue in the Mediterranean, it is a primary issue in Southeast Asia, and it is a primary issue in the United States as well as Central and South America. This is a Global Issue and Global Issues can only be resolved with Global Solutions.

Unless the world comes to grips of what happens on these transnational transgressions, it will be a global economic factor that, like an untreated sore, will fester and become a major injury. We in the US need to address the problem along with all these other nations. If it is just left to regions, as the US State Department is recommending, it will continue to be unaddresed - just as it continues to be unaddresed here in the US.

When will the US realize that Global problems require Global solutions - not regional?

Reply by LarryL1970 to David Kimball

What are "global solutions" in this scenario? Certainly you don't suggest nations open their borders and allow unrestricted immigration? The math simply won't work and nations practicing that policy would soon be overwhelmed by the economic and social burdens. How do we find "global solutions' for entire continents where corruption, civil war, climate change, secular violence, religious strife, unchecked disease, and widespread illiteracy offer such formidable barriers to success? Who pays the bills?

(source: the two ways : breaking news from npr : npr.org May 15 2015)

Friday, May 15, 2015

CEBISAN CERITA 1MDB

1MDB

Be bold and daring… to break new ground and do things differently

Prime Minister Dato’ Sri Mohd Najib Tun Haji Abdul Razak

instructs the 1MDB team on 11 January 2010

instructs the 1MDB team on 11 January 2010

Vision

A strategic enabler for new ideas and sources of growth

Mission

To drive sustainable economic development by forging strategic global partnerships and promoting FDI

----------------------------------------------------------------------------------------------------------

Tun Razak Exchange

International Financial Centre to Rival Asia’s Best

In line with the Economic Transformation Programme’s identification of the financial sector and Greater KL as key sources of growth towards a high income nation, 1MDB officially launched the Tun Razak Exchange (TRX) on 30 July 2012.

1MDB acts as the master developer for the 70-acre area in Imbi fronting Jalan Tun Razak.

TRX will encourage innovation and propel growth by creating a strategic clustering of global talents, world-class multinationals and complementary lifestyle amenities in a highly connected location with state-of-the-art infrastructure and world-class sustainability standards.

“The tax and other incentives for Tun Razak Exchange (TRX)-status companies tabled at Budget 2013 are great steps taken to attract major international financial institutions into the country, according to industry players.

[Prime Minister Datuk Seri Najib Razak] launched the TRX with a gross development value of RM26bil as an initiative to promote Malaysia as an international financial hub and to attract foreign direct investment.

TRX will provide new investment opportunities by connecting the business community with the global market.

TRX is expected to attract 250 international financial services companies and offer 40,000 knowledge and skilled job opportunities.

Property consultancy C.H. Williams Talhar & Wong said the TRX “could create new demand for at least 6 million sq ft of new office space, which will buoy the office property sector.”

Aberdeen Islamic Asset Management CEO Abdul Jalil Abdul Rasheed said the "tax exemptions… underscored the forward-thinking approach on the part of the Government to position Malaysia as a central investment; and remain a vibrant and competitive financial hub in the years to come.”

(The Star, “Incentives for TRX-status firms will attract foreigners”

29 September 2012)

29 September 2012)

Dr M: Probe 1MDB without fear or favour

In a vehement and vitriolic attack, Dr Mahathir Mohamad has called for

any investigation of 1MDB to be executed without fear or favour.

“Investigations into Malaysia’s controversial 1MDB fund must be done

without fear or favour and those found responsible, no matter who, must

be prosecuted without delay and the sooner the better or the government

will suffer further reputation loss.

(Krishnamoorthy : Malaysiakini 15/05/15)

--------------------------------------------------------------------------------------------------------------

1MDB receives clean audit report by CCM - Hasan

KUALA

PILAH, March 7 (Bernama) -- The 1Malaysia Development Berhad (1MDB) has

received a clean audit report (unqualified) for its audited financial

statements for the year 2010-2014 by the Companies Commission of

Malaysia (CCM).

Domestic Trade, Cooperatives and Consumerism Minister Datuk Seri Hasan Malek said until today, no reports of serious offenses such as fraud and dishonesty were detected during the audit of 1MDB.

It was an offense under the Companies Act 1965 if the auditor did not report any serious offense to the CCM, which carries a jail term of seven years or RM250,000 fine or both, he said in a statement here.

Therefore, he said, any wrongdoing of 1MDB funds was merely an allegation and had been refuted by related parties including 1MDB and Petro Saudi Limited.

-- BERNAMA

-------------------------------------------------------------------------------------------------------------

KUALA LUMPUR, Feb 18 (Reuters) - Malaysian state fund 1MDB said it would explore asset sales and the sale of development rights in prime property projects as it seeks to cut its debt - a $11.6 billion burden that has weighed on the ringgit and the country's sovereign credit rating.

The plans are part of a strategic review led by new 1MDB chief Arul Kanda as he attempts to make the fund more transparent after years of controversy over its debt, late financial reports and late loan payments.

1MDB, the fund whose advisory board is chaired by Prime Minister Najib Razak, said it recognised it had to reform its debt-heavy capital structure and would not take on any more projects or debt, helping the ringgit climb 1 percent against the dollar on Wednesday.

But the review did not contain any debt reduction targets and few details about a long-delayed $3 billion IPO for its power unit, Edra Energy, that is due this year.

"The announcement is positive but in order to get a bigger positive you need more clarity on the existing structure of debt and what kind of liabilities are outstanding and the repayment schedule in the next 12 months," said Michael Wan, an economist with Credit Suisse in Singapore.

Arul, who took the helm last month, said the firm has not set itself a debt reduction target, as more than three quarters of its debt is long term.

Just last week, 1MDB settled a 2 billion ringgit ($550 million) loan it owed to banks but financial sources have said it needed a loan from Malaysia's second-richest man Ananda Krishnan to do so.

"Of the short-term debt maturity the 2 billion ringgit debt was the biggest, which has now been paid," Arul told Reuters in an interview.

Arul declined to comment on IPO plans for the fund's power unit, which owns 15 power and desalination plants in five countries. 1MDB said only that it planned to "monetise" the asset this year, with some proceeds to go towards future growth and the rest going towards repaying short-term debt.

Some land assets it owns outside the capital may be sold outright or partly sold through joint ventures, 1MDB said.

But two projects in central Kuala Lumpur - the Tun Razak Exchange which is being developed into a financial district and Bandar Malaysia, a commercial and residential development - will continue to be owned by the finance ministry.

They will, however, now be run as standalone entities and in addition to the sale of land development rights, the projects could also enter into profit-sharing joint ventures, it said.

Fitch Ratings, which has put Malaysia's A-minus credit rating under review with a negative outlook, has said it has concerns over Malaysia's fiscal position and contingent liabilities such as those from 1MDB. ($1 = 3.6180 ringgit)

(Reporting by Al-Zaquan Amer Hamzah and Praveen Menon; Editing by Edwina Gibbs)

--------------------------------------------------------------------------------------------------------------

YANG DI BISINGKAN DAN DIHEBOHKAN BILA THP NAK BELI DULU

SUMBANGAN YAYASAN 1MDB

Domestic Trade, Cooperatives and Consumerism Minister Datuk Seri Hasan Malek said until today, no reports of serious offenses such as fraud and dishonesty were detected during the audit of 1MDB.

It was an offense under the Companies Act 1965 if the auditor did not report any serious offense to the CCM, which carries a jail term of seven years or RM250,000 fine or both, he said in a statement here.

Therefore, he said, any wrongdoing of 1MDB funds was merely an allegation and had been refuted by related parties including 1MDB and Petro Saudi Limited.

-- BERNAMA

-------------------------------------------------------------------------------------------------------------

KUALA LUMPUR, Feb 18 (Reuters) - Malaysian state fund 1MDB said it would explore asset sales and the sale of development rights in prime property projects as it seeks to cut its debt - a $11.6 billion burden that has weighed on the ringgit and the country's sovereign credit rating.

The plans are part of a strategic review led by new 1MDB chief Arul Kanda as he attempts to make the fund more transparent after years of controversy over its debt, late financial reports and late loan payments.

1MDB, the fund whose advisory board is chaired by Prime Minister Najib Razak, said it recognised it had to reform its debt-heavy capital structure and would not take on any more projects or debt, helping the ringgit climb 1 percent against the dollar on Wednesday.

But the review did not contain any debt reduction targets and few details about a long-delayed $3 billion IPO for its power unit, Edra Energy, that is due this year.

"The announcement is positive but in order to get a bigger positive you need more clarity on the existing structure of debt and what kind of liabilities are outstanding and the repayment schedule in the next 12 months," said Michael Wan, an economist with Credit Suisse in Singapore.

Arul, who took the helm last month, said the firm has not set itself a debt reduction target, as more than three quarters of its debt is long term.

Just last week, 1MDB settled a 2 billion ringgit ($550 million) loan it owed to banks but financial sources have said it needed a loan from Malaysia's second-richest man Ananda Krishnan to do so.

"Of the short-term debt maturity the 2 billion ringgit debt was the biggest, which has now been paid," Arul told Reuters in an interview.

Arul declined to comment on IPO plans for the fund's power unit, which owns 15 power and desalination plants in five countries. 1MDB said only that it planned to "monetise" the asset this year, with some proceeds to go towards future growth and the rest going towards repaying short-term debt.

Some land assets it owns outside the capital may be sold outright or partly sold through joint ventures, 1MDB said.

But two projects in central Kuala Lumpur - the Tun Razak Exchange which is being developed into a financial district and Bandar Malaysia, a commercial and residential development - will continue to be owned by the finance ministry.

They will, however, now be run as standalone entities and in addition to the sale of land development rights, the projects could also enter into profit-sharing joint ventures, it said.

Fitch Ratings, which has put Malaysia's A-minus credit rating under review with a negative outlook, has said it has concerns over Malaysia's fiscal position and contingent liabilities such as those from 1MDB. ($1 = 3.6180 ringgit)

(Reporting by Al-Zaquan Amer Hamzah and Praveen Menon; Editing by Edwina Gibbs)

--------------------------------------------------------------------------------------------------------------

YANG DI BISINGKAN DAN DIHEBOHKAN BILA THP NAK BELI DULU

Tun

Razak Exchange (TRX), Kuala Lumpur’s upcoming international financial

district, announced today that it has signed Indonesia’s leading

property developer Mulia Group on board to develop its Signature Tower.

This follows the signing of the Sale and Purchase agreement between 1MDB Real Estate Sdn Bhd (1MDB RE), the master developer of TRX, and the Mulia Group for the development rights of the plot. The land transaction is valued at RM665 million.

1MDB RE Chief Executive Officer Dato’ Azmar Talib said, “We are pleased to have the Mulia Group on board towards realising the potential of the Tun Razak Exchange. This significant investment underscores foreign investor confidence in Malaysia.”

The Mulia Group, which has a leading market share for premium commercial properties in Jakarta, developed, owns and manages seven premier office buildings in Jakarta's central business district, including the Wisma Mulia 1 and 2.

Wisma Mulia 1 and 2 are ranked amongst Jakarta’s tallest and most prestigious office buildings that together house key global and local blue-chip companies in Indonesia. The Mulia group has also developed and managed internationally renowned hotels, and residential and shopping mall properties.

Eka Tjandranegara, President Director and owner of the Mulia Group said, “As one of the biggest commercial property developers in Indonesia, we are excited to be embarking on this project to develop the Signature Tower to become the new landmark of Kuala Lumpur city. Our Mulia Group wishes to be an integral part of this iconic state-of-the-art development not only for Malaysia but for the region and beyond."

“We see TRX’s potential to further develop the city’s role as a financial capital, and the Tun Razak Exchange aids our growth and expansion plans. I am committed to personally seeing this project through, drawing from our vast experience.”

The Mulia Group’s properties also include their award-winning Hotel Mulia Bali which essentially comprises of The Mulia, Mulia Resort & Villas in Nusa Dua, Bali. In the past two years, the resorts have been awarded six prestigious awards by Condé Nast, with the latest award placing Mulia Bali as the #1 Beach Resort in the World.

The landmark Signature Tower building will be a highly visible focal point for TRX, targeted to be the best international business address in Kuala Lumpur. As it will be TRX's tallest building and have its largest floor plates, the tower is poised to be a Prime Grade A office space in Kuala Lumpur.

Mulia Group now joins the list of investors such as Lend Lease International, a global property and infrastructure group developing the RM8 billion Lifestyle Quarter; and Veolia Water Technologies, whose water management technology will halve potable water use in TRX.

TRX is investing significantly in its infrastructure to create a truly accessible world-class financial hub. Tenants are expected to enjoy unrivalled connectivity to the city center and the rest of Greater KL, being a few steps away from the largest integrated underground MRT interchange station.

The MRT will connect TRX to the upcoming High Speed Rail terminus station at Bandar Malaysia, linking TRX to Singapore’s financial center.

TRX will also have direct link to key roads and major highways such as SMART, MEX, Jalan Tun Razak and Jalan Sultan Ismail. It is working with Dewan Bandaraya Kuala Lumpur in uplifting the Imbi area, by upgrading surrounding streetscapes and constructing a pedestrian avenue that connects TRX with the Bukit Bintang shopping district.

------------------------------------------------------------------------------------------------------------

This follows the signing of the Sale and Purchase agreement between 1MDB Real Estate Sdn Bhd (1MDB RE), the master developer of TRX, and the Mulia Group for the development rights of the plot. The land transaction is valued at RM665 million.

1MDB RE Chief Executive Officer Dato’ Azmar Talib said, “We are pleased to have the Mulia Group on board towards realising the potential of the Tun Razak Exchange. This significant investment underscores foreign investor confidence in Malaysia.”

The Mulia Group, which has a leading market share for premium commercial properties in Jakarta, developed, owns and manages seven premier office buildings in Jakarta's central business district, including the Wisma Mulia 1 and 2.

Wisma Mulia 1 and 2 are ranked amongst Jakarta’s tallest and most prestigious office buildings that together house key global and local blue-chip companies in Indonesia. The Mulia group has also developed and managed internationally renowned hotels, and residential and shopping mall properties.

Eka Tjandranegara, President Director and owner of the Mulia Group said, “As one of the biggest commercial property developers in Indonesia, we are excited to be embarking on this project to develop the Signature Tower to become the new landmark of Kuala Lumpur city. Our Mulia Group wishes to be an integral part of this iconic state-of-the-art development not only for Malaysia but for the region and beyond."

“We see TRX’s potential to further develop the city’s role as a financial capital, and the Tun Razak Exchange aids our growth and expansion plans. I am committed to personally seeing this project through, drawing from our vast experience.”

The Mulia Group’s properties also include their award-winning Hotel Mulia Bali which essentially comprises of The Mulia, Mulia Resort & Villas in Nusa Dua, Bali. In the past two years, the resorts have been awarded six prestigious awards by Condé Nast, with the latest award placing Mulia Bali as the #1 Beach Resort in the World.

The landmark Signature Tower building will be a highly visible focal point for TRX, targeted to be the best international business address in Kuala Lumpur. As it will be TRX's tallest building and have its largest floor plates, the tower is poised to be a Prime Grade A office space in Kuala Lumpur.

Mulia Group now joins the list of investors such as Lend Lease International, a global property and infrastructure group developing the RM8 billion Lifestyle Quarter; and Veolia Water Technologies, whose water management technology will halve potable water use in TRX.

TRX is investing significantly in its infrastructure to create a truly accessible world-class financial hub. Tenants are expected to enjoy unrivalled connectivity to the city center and the rest of Greater KL, being a few steps away from the largest integrated underground MRT interchange station.

The MRT will connect TRX to the upcoming High Speed Rail terminus station at Bandar Malaysia, linking TRX to Singapore’s financial center.

TRX will also have direct link to key roads and major highways such as SMART, MEX, Jalan Tun Razak and Jalan Sultan Ismail. It is working with Dewan Bandaraya Kuala Lumpur in uplifting the Imbi area, by upgrading surrounding streetscapes and constructing a pedestrian avenue that connects TRX with the Bukit Bintang shopping district.

------------------------------------------------------------------------------------------------------------

SUMBANGAN YAYASAN 1MDB

Get

independent audit or quit, Nazir tells 1MDB directors - See more at:

http://www.themalaysianinsider.com/malaysia/article/get-independent-audit-or-quit-nazir-tells-1mdb-directors#sthash.snof8GXC.dpuf

CIMB

Group Bhd Chairman Datuk Seri Nazir Razak said that the board of

1Malaysia Development Bhd (1MDB) should resign if they did not want to

take active measures to address concerns over its finances, The Star

reported today.

The brother of Prime Minister Datuk Seri Najib Razak said it was irresponsible for the debt-ridden state investment arm to do nothing and simply wait for the Auditor-General (A-G) to complete its investigation.

“The immediate check for a responsible board is to appoint an independent (auditor) now … otherwise the board and management, in my view, should resign," Nazir was quoted as saying

- See more at: http://www.themalaysianinsider.com/malaysia/article/get-independent-audit-or-quit-nazir-tells-1mdb-directors#sthash.snof8GXC.dpuf

The brother of Prime Minister Datuk Seri Najib Razak said it was irresponsible for the debt-ridden state investment arm to do nothing and simply wait for the Auditor-General (A-G) to complete its investigation.

“The immediate check for a responsible board is to appoint an independent (auditor) now … otherwise the board and management, in my view, should resign," Nazir was quoted as saying

- See more at: http://www.themalaysianinsider.com/malaysia/article/get-independent-audit-or-quit-nazir-tells-1mdb-directors#sthash.snof8GXC.dpuf

CIMB

Group Bhd Chairman Datuk Seri Nazir Razak said that the board of

1Malaysia Development Bhd (1MDB) should resign if they did not want to

take active measures to address concerns over its finances, The Star

reported today.

The brother of Prime Minister Datuk Seri Najib Razak said it was irresponsible for the debt-ridden state investment arm to do nothing and simply wait for the Auditor-General (A-G) to complete its investigation.

“The immediate check for a responsible board is to appoint an independent (auditor) now … otherwise the board and management, in my view, should resign," Nazir was quoted as saying.

- See more at: http://www.themalaysianinsider.com/malaysia/article/get-independent-audit-or-quit-nazir-tells-1mdb-directors#sthash.snof8GXC.dpuf

The brother of Prime Minister Datuk Seri Najib Razak said it was irresponsible for the debt-ridden state investment arm to do nothing and simply wait for the Auditor-General (A-G) to complete its investigation.

“The immediate check for a responsible board is to appoint an independent (auditor) now … otherwise the board and management, in my view, should resign," Nazir was quoted as saying.

- See more at: http://www.themalaysianinsider.com/malaysia/article/get-independent-audit-or-quit-nazir-tells-1mdb-directors#sthash.snof8GXC.dpuf

CIMB

Group Bhd Chairman Datuk Seri Nazir Razak said that the board of

1Malaysia Development Bhd (1MDB) should resign if they did not want to

take active measures to address concerns over its finances, The Star

reported today.

The brother of Prime Minister Datuk Seri Najib Razak said it was irresponsible for the debt-ridden state investment arm to do nothing and simply wait for the Auditor-General (A-G) to complete its investigation.

“The immediate check for a responsible board is to appoint an independent (auditor) now … otherwise the board and management, in my view, should resign," Nazir was quoted as saying.

- See more at: http://www.themalaysianinsider.com/malaysia/article/get-independent-audit-or-quit-nazir-tells-1mdb-directors#sthash.snof8GXC.dpuf

The brother of Prime Minister Datuk Seri Najib Razak said it was irresponsible for the debt-ridden state investment arm to do nothing and simply wait for the Auditor-General (A-G) to complete its investigation.

“The immediate check for a responsible board is to appoint an independent (auditor) now … otherwise the board and management, in my view, should resign," Nazir was quoted as saying.

- See more at: http://www.themalaysianinsider.com/malaysia/article/get-independent-audit-or-quit-nazir-tells-1mdb-directors#sthash.snof8GXC.dpuf

Get

independent audit or quit, Nazir tells 1MDB directors - See more at:

http://www.themalaysianinsider.com/malaysia/article/get-independent-audit-or-quit-nazir-tells-1mdb-directors#sthash.snof8GXC.dpuf

Get

independent audit or quit, Nazir tells 1MDB directors - See more at:

http://www.themalaysianinsider.com/malaysia/article/get-independent-audit-or-quit-nazir-tells-1mdb-directors#sthash.snof8GXC.dpuf

Get

independent audit or quit, Nazir tells 1MDB directors - See more at:

http://www.themalaysianinsider.com/malaysia/article/get-independent-audit-or-quit-nazir-tells-1mdb-directors#sthash.snof8GXC.dpuf

Wednesday, May 13, 2015

ROHINGYA .... APA LAH NASIB MANUSIA-MANUSIA INI.

Malaysia tells thousands of Rohingya refugees to 'go back to your country'

Minister says his country is unwilling to accept boatloads of people fleeing poverty and persecution in Bangladesh and Burma.

Malaysia said on Wednesday it would no longer accept new arrivals of ethnic minority Rohingya fleeing persecution in Burma, as the UN refugee agency expressed surprise that south-east Asian nations were now turning back boats.

Up to 8,000 impoverished Bangladeshi migrants and Rohingya asylum seekers are still believed to be stranded at sea close to Malaysia and Indonesia.

Nearly 2,000 were rescued from abandoned people-smuggling boats in the two countries at the weekend.

One vessel that reached Indonesian waters early on Monday was turned away by the country’s navy after being given supplies and directions to Malaysia.

Malaysia’s deputy home minister, Wan Junaidi Tuanku Jaafar, however, said his country would use tough measures, including turning back asylum-seeker boats and deportation in order to send the “right message”.

“We don’t want them to come here,” the deputy minister said. His ministry oversees the police and immigration agencies.

“We are not prepared to accept that number coming into our shores and those people who are already in, we are sending them home anyway.

“I would like them to be turned back and ask them to go back to their own country. We cannot tell them we are welcoming them.”

--------------------------------------------------------------------------------------------------------------------

The passengers were calling for help and crying down the phone, said Chris Lewa of the Arakan Project which works with the Rohingya ethnic minority.

The migrants are not sure where they are and their boat is drifting.

"They say the boat is a Thai boat and the crew and captain are Thai. They have been two months at sea. The day before yesterday crew and captain abandoned the boat, arranged a boat for themselves, and they took parts of the engine so it's not working," Ms Lewa told the BBC on Tuesday.

-----------------------------------------------------------------------------------------------------------------------

Malaysia said on Wednesday it would no longer accept new arrivals of ethnic minority Rohingya fleeing persecution in Burma, as the UN refugee agency expressed surprise that south-east Asian nations were now turning back boats.

Up to 8,000 impoverished Bangladeshi migrants and Rohingya asylum seekers are still believed to be stranded at sea close to Malaysia and Indonesia.

Nearly 2,000 were rescued from abandoned people-smuggling boats in the two countries at the weekend.

One vessel that reached Indonesian waters early on Monday was turned away by the country’s navy after being given supplies and directions to Malaysia.

Malaysia’s deputy home minister, Wan Junaidi Tuanku Jaafar, however, said his country would use tough measures, including turning back asylum-seeker boats and deportation in order to send the “right message”.

“We don’t want them to come here,” the deputy minister said. His ministry oversees the police and immigration agencies.

“We are not prepared to accept that number coming into our shores and those people who are already in, we are sending them home anyway.

“I would like them to be turned back and ask them to go back to their own country. We cannot tell them we are welcoming them.”

--------------------------------------------------------------------------------------------------------------------

Myanmar Rohingya migrants 'begging for help' from boat

A group of 350 migrants from Myanmar have told an activist by phone that they have been abandoned by their crew and need help.

The migrants, including 50 women and 84 children, say they have had no food or water for three days.The passengers were calling for help and crying down the phone, said Chris Lewa of the Arakan Project which works with the Rohingya ethnic minority.

The migrants are not sure where they are and their boat is drifting.

"They say the boat is a Thai boat and the crew and captain are Thai. They have been two months at sea. The day before yesterday crew and captain abandoned the boat, arranged a boat for themselves, and they took parts of the engine so it's not working," Ms Lewa told the BBC on Tuesday.

-----------------------------------------------------------------------------------------------------------------------

Who Are the Rohingya and Why Are They Fleeing Myanmar?

Around 1,600 refugees from Myanmar and Bangladesh were rescued off the coast of Indonesia on Sunday and detained in Malaysia on Monday.

Malaysian officials said Monday that 1,081 Bangladeshi and

Rohingya refugees landed on the country’s Langkawi Island. On Sunday,

600 “sad, tired and distressed”

migrants were stranded off the coast of the Indonesian province of

Aceh. On Monday, another 400 were found aboard a ship, the BBC reports.

Hundreds of those people are believed to be Rohingya, the

ethnic Muslim minority in Myanmar who for decades have faced

discrimination and persecution in the majority-Buddhist country. The

government of Myanmar considers the country’s approximately 1.33 million

Rohingya illegal settlers, and the United Nations classifies them as one of the most persecuted refugee groups in the world.

On her visit to the country earlier this year,

Yanghee Lee, the U.N. special rapporteur on human rights in Myanmar, saw

“no improvement” in the way the Rohingya were being treated.

“The conditions in Muslim [internally displaced person]

camps are abysmal, and I received heartbreaking testimonies from

Rohingya people telling me they had only two options: stay and die or

leave by boat,” she said in a statement.

Malaysia and Indonesia are both majority-Muslim countries.

Between 1826 and 1948, the Rohingya were brought from India by the British during their colonial rule to work in Myanmar. Since then, their origin has been disputed, with some believing they hail from Bangladesh and others saying they came from Rakhine state in southeastern Myanmar.

Between 1826 and 1948, the Rohingya were brought from India by the British during their colonial rule to work in Myanmar. Since then, their origin has been disputed, with some believing they hail from Bangladesh and others saying they came from Rakhine state in southeastern Myanmar.

Myanmar’s president, Thein Sein, denies there have been human rights abuses

against the Rohingya, calling such reports “pure fabrication.” He also

denies that the Rohingya are a people and refers to them as “Bengalis.”

Calling the Rohingya “Bengali” is “a discriminatory, xenophobic way of

erroneously implying that Rohingya are illegal immigrants from

Bangladesh,” says the U.S. Campaign for Burma,

a Washington-based nonprofit. Sein has called on the U.N. to facilitate

the deportation of the Rohingya to other countries, but the U.N. rejected the proposal.

Last year, Myanmar unveiled a controversial plan

offering Rohingya citizenship if they changed their ethnicity to

Bangladeshi in origin. For the Rohingya, calling themselves “Bengali”

implies they are illegally in the country, which most of them reject.

In 1982, the Rohingya were stripped of their citizenship by

the government of Myanmar, then known as Burma. The Burma Citizenship

Law also restricted their access to education, services and freedom of

movement, and allowed property to be taken arbitrarily. More than 140,000 Rohingya

live in internally displaced persons camps around Sittwe, the capital

of Rakhine state, in southwest Myanmar, where they are entirely

dependent on international assistance, Human Rights Watch said in 2014.

More than 200,000 Rohingya refugees live in Bangladesh, according to Refugees International. They are effectively stateless.

Advocates fear violence and discrimination against the

Rohingya is escalating, fueling a surge in treacherous boat journeys.

Last year, more than 40 Rohingya were massacred

in the village of Du Chee Yar Tan by local men, the U.N. confirmed.

Among the findings were 10 severed heads in a water tank, including

those of children.

Earlier this month, dozens of bodies were discovered in smugglers’ camps in Thailand. Many of the victims were believed to be Rohingya. Tuesday, May 12, 2015

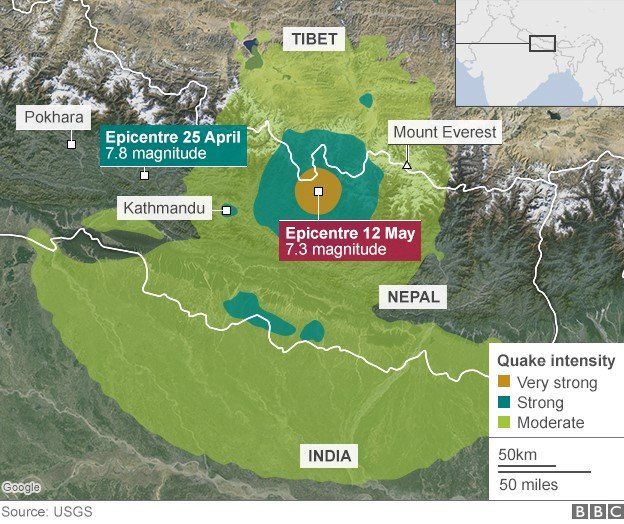

EARTH QUAKE STRUCK NEPAL AGAIN : BBC NEWS

Source and Credit To : BBC New (12/05/15)

The latest earthquake hit near the town of Namche Bazaar, near Mount Everest.

The US Geological Survey said it had a magnitude of 7.3. An earthquake on 25 April, centred in western Nepal, had a magnitude of 7.8.

The latest tremor was also felt in northern India and Bangladesh.

Since 25 April, the immediate analysis had suggested that more activity on the fault was possible because the previous event had not ruptured all the way to the surface. That meant some of the strain built up in the rocks over the years had not all been released.

One has to hope that the buildings which were damaged last time have been felled in subsequent aftershocks, or have been put out of bounds. This will limit the casualties this time. But further landslides and avalanches in the mountainous terrain are a persistent risk.

And, of course, another big tremor does nothing for the frayed nerves of an already anxious population.

A major earthquake has struck eastern Nepal, near Mount Everest, two weeks after more than 8,000 died in a devastating quake.

At least four people have been killed and an unknown number injured, according to aid agencies. The latest earthquake hit near the town of Namche Bazaar, near Mount Everest.

The US Geological Survey said it had a magnitude of 7.3. An earthquake on 25 April, centred in western Nepal, had a magnitude of 7.8.

The latest tremor was also felt in northern India and Bangladesh.

Analysis: Jonathan Amos, BBC News, Science Correspondent

By any stretch, a magnitude-7.3 quake is a big one. It's not quite as big as the quake on 25 April (7.8), which was 5.5 times more energetic, but it's a major tremor nonetheless.Since 25 April, the immediate analysis had suggested that more activity on the fault was possible because the previous event had not ruptured all the way to the surface. That meant some of the strain built up in the rocks over the years had not all been released.

One has to hope that the buildings which were damaged last time have been felled in subsequent aftershocks, or have been put out of bounds. This will limit the casualties this time. But further landslides and avalanches in the mountainous terrain are a persistent risk.

And, of course, another big tremor does nothing for the frayed nerves of an already anxious population.

Sunday, May 10, 2015

TH DAN IMDB

Isu TH beli tanah dari IMDB tu memang betui-betui isu yang besar....apa nak buat apabila ianya melibatkan perlaburan daripada satu tabong yang di bentuk bagi tujuan menunaikan haji satu hari nanti.

Itu aku tak kisah lah sangat, aku adalah pendeposit dan kalu ikut giliran, aku mungkin hanya dapat menunaikan haji pada tahun 2023. Harap-harap dapat pegi sana lebih awal lagi...kalau ada rezeki.

Tapi yang aku benar-benar kisah ialah ; kenapa harus ada penafian tak beli, lepas tu kata beli dan sekarang nak di jual atas nasihat PM. Tolak bab penafian tu, kalu kita beli barang, dan dapat jual dengan keuntungan tak sampai seminggu, itu makna nya perlaburan dan perniagaan yang baik. Keputusan membeli untuk tujuan pelaburan dan kemudian di jual dengan harga yang lebih tinggi dan menguntungkan, keputusan itu amat amat baik tapi jika di jual atas nasihat PM demi mengurangkan kontroversi....itu yang mencurigakan.

Kata kawan-kawan aku, " a threat is an opportunity to others". Macam hal IMDB tu, kesulitan mencari dan menjana sumber bagi melangsaikan hutang atau faedah atas pinjaman itu adalah satu "threat" pada 1MDB tapi ianya peluang untuk TH membuat pelaburan dengan mengusulkan membeli tanah di satu lokasi yang strategik di TRX, yang di milikki oleh IMDB. So, kalu harga nya berpatutan dan TH di jangka memperolehi keuntungan dari pembelian ini, maka ianya satu pelaburan yang baik dan jelas tidak berisiko tinggi. Tapi jika tanah di beli, di simpan dan di pendam, maka ianya pembazirkan sumber... sumber yang terpendam!!. Dan jika tanah itu di beli dan kemudian di bangunkan, maka keputusan membangunkan tanah itu memerlukan satu kajian dari segi "feasibility" dan "profitability" nya. Di sini ada risiko nya....tinggi atau rendah nya risiko tu. Itu lah yang perlu di hadapi... Dalam perniagaan, semua nya ada risiko!!!!

So, dah jual...maka harap untung dari segi jual beli saja lah...

Itu aku tak kisah lah sangat, aku adalah pendeposit dan kalu ikut giliran, aku mungkin hanya dapat menunaikan haji pada tahun 2023. Harap-harap dapat pegi sana lebih awal lagi...kalau ada rezeki.

Tapi yang aku benar-benar kisah ialah ; kenapa harus ada penafian tak beli, lepas tu kata beli dan sekarang nak di jual atas nasihat PM. Tolak bab penafian tu, kalu kita beli barang, dan dapat jual dengan keuntungan tak sampai seminggu, itu makna nya perlaburan dan perniagaan yang baik. Keputusan membeli untuk tujuan pelaburan dan kemudian di jual dengan harga yang lebih tinggi dan menguntungkan, keputusan itu amat amat baik tapi jika di jual atas nasihat PM demi mengurangkan kontroversi....itu yang mencurigakan.

Kata kawan-kawan aku, " a threat is an opportunity to others". Macam hal IMDB tu, kesulitan mencari dan menjana sumber bagi melangsaikan hutang atau faedah atas pinjaman itu adalah satu "threat" pada 1MDB tapi ianya peluang untuk TH membuat pelaburan dengan mengusulkan membeli tanah di satu lokasi yang strategik di TRX, yang di milikki oleh IMDB. So, kalu harga nya berpatutan dan TH di jangka memperolehi keuntungan dari pembelian ini, maka ianya satu pelaburan yang baik dan jelas tidak berisiko tinggi. Tapi jika tanah di beli, di simpan dan di pendam, maka ianya pembazirkan sumber... sumber yang terpendam!!. Dan jika tanah itu di beli dan kemudian di bangunkan, maka keputusan membangunkan tanah itu memerlukan satu kajian dari segi "feasibility" dan "profitability" nya. Di sini ada risiko nya....tinggi atau rendah nya risiko tu. Itu lah yang perlu di hadapi... Dalam perniagaan, semua nya ada risiko!!!!

So, dah jual...maka harap untung dari segi jual beli saja lah...

Saturday, May 09, 2015

Malaysia Economic Outlook 2015 : Executive Briefing Scotia Bank.

March 2015

Executive Briefing

is available on scotiabank.com and Bloomberg at SCOT

Global Economics

MALAYSIA

Executive

Briefing

Tuuli McCully

1.416.863.2859

tuuli.mccully@scotiabank.com

Executive Briefing

is available on scotiabank.com and Bloomberg at SCOT

Capital Market Dynamics

Foreign Exchange

►

The Malaysian ringgit (MYR) is facing a period of weakness as investors readjust their portfolios' emerging market portfolios’ emerging market exposure and lower international oil prices lead to a narrowing of

Malaysia’s currentaccount surplus. While the country’s authorities maintain a managed float policy for the MYR against a trade-weighted currency basket, the MYR has lost 13.8% vis-à-vis the US dollar (USD) over the past six months. We expect the currency to close 2015 at 3.76 per USD,implying a 7% depreciation since the end of 2014.

Sovereign Debt & Credit Ratings

►

The Malaysian sovereign credit rating outlook is mixed: Fitch Ratings assigns a “negative” outlook to

Malaysia’s long-term foreign currency rating of “A-”, while Moody’s holds a “positive” outlook on its corresponding “A3” assessment. Meanwhile, Standard & Poor’s rates Malaysia in thesame rating category, with a “stable” outlook, judging that the country’s net external asset position, monetary Malaysiaflexibility, and diversified economy counterbalance its fiscal weakness. Malaysia’s gross public debt will likely hover around 55% of GDP through 2016, somewhat higher than the average of its regional peers. Credit default swaps indicate a deterioration in investors’ perceptionof Malaysia’s creditworthiness: they hover close to 140basis points (bps), significantly abovethe six-month average level of 97 bps.

Economic Outlook

Growth

►

The Malaysian economy continues to record strong perfromance. Real GDP growth reached 5.8% y/y

in the fourth quarter of 2014 following a 5.6% advance in the July-September period, taking the gain to 6% in 2014 as a whole. Activity remains broadly-based with domestic demand being the key driving force. Private consumption continues to be underpinned by rising incomes,supportive labour market conditions, and lower fuel prices, whereas investment activity is bolstered by both public and private sector outlays. This should counterbalance the expected investment downturn in the oil and gas sector. We anticipate a modest real GDP growth deceleration to take place in the coming quarters,reflecting slower gains in the export sector due to lower international commodity prices. Output expansion will likely average 5% annually in 2015-16.

Inflation & Monetary Context

►

The collapse in international energy prices is reflected in inflation; consumer prices increased by 1.0% y/y in January, dropping substantially from the 3.1% average advance recorded in 2014. The implementation of a goods and services tax in April 2015 will lead to a temporary pick-up in price gains, with inflation likely hovering around 3% y/y at the end of the year before easing to 2½% by the end of 2016. We expect the central bank to maintain monetary conditions unchanged in the coming months as the inflationary impact

stemming from robust domestic demand is partially offset by lower energy prices. Policymakers increased the benchmark interest rate by 25 bps to 3.25% last July after the rate had been kept unchanged for over three years.

Fiscal & Current Account Balance

►

Public finances are Malaysia’s weakest link. The government’s oil and gas revenues (which account for 30% of total revenue) will be suppressed by lower oil prices, prompting authorities to revise the 2015 budget deficit projection upwards to 3.2% of GDP. Nevertheless, the price drop allowed Prime Minister Najib Razak to announce a fuel subsidy reform in November 2014, which will offer counterbalancing

support to public finances and sovereign creditworthiness. The fuel subsidy bill (2.5% of GDP in 2013) has been one of the highest in the region alongside Indonesia. Furthermore, the implementation of the goods and services tax in April will alleviate pressure on public finances. As Malaysia is a net oil exporter,

lower global oil prices have caused a deterioration in the country’s terms of trade with its current account surplus likely shrinking to an average of 3½% of GDP in 2015-16 from 4.6% in 2014.

Petikan dari CNBC bertarikh 7 Januari 2015

It's not just oil: Trouble brews for Malaysia

Sharp currency depreciation and the introduction of a goods & services tax (GST) are widely expected to drag 2015 gross domestic product (GDP) growth below 5 percent from an estimated 5.8 percent in 2014.

The dramatic decline in crude is also playing a role for emerging Asia's only major energy exporting economy. Brent's 54 percent plunge over the past six months has noticeably hurt Malaysia, where petroleum products and liquefied natural gas account for 14 percent of exports.

Barclays recently reduced its 2015 GDP forecast to 4.5 percent from 5.5 percent following a similar downgrade by the World Bank to 4.7 percent, both well below the government's 5-6 percent growth forecast.

Upbeat November trade data on Wednesday showed Malaysia's trade surplus at a three-year high but failed to improve the country's outlook. According to ANZ, the trade balance could potentially be an "Achilles' heel" in 2015 due to pressure from lower oil prices.

Currency volatility

The Malaysian ringgit weakened to its lowest level against the U.S. dollar since July 2009 this week, chalking up losses of over 12 percent in the past six months. The pair is currently trading around 3.5580, within striking distance of 3.60 and not far from 3.70, a level not seen since the Asian Financial Crisis.

"I don't think there's a lot of optimism or hope for relief in the short-term. On a relative value basis, it looks attractive on the short side," Todd Elmer, currency strategist at Citi, told CNBC on Wednesday.

Capital outflows on prospects of a U.S. interest rate hike this year are weighing on the ringgit, according to experts. With foreign reserves dropping from $134.9 billion in 2013 to $120.7 billion as of December, officials have requested that government-linked companies scale back foreign investments in order to contain outflows, Barclays noted.

Hello GST

Prime Minister Razak is expected to introduce a GST tax of

6 percent in April, which could add 1.2 percentage points to headline

inflation and weigh on discretionary spending, according to Barclays.

The tax also led the bank to lower its 2015 inflation forecast to 2.6 percent, from 3.8 percent - significantly below the government's 3-4 percent forecast.

Moreover, Barclays notes that concerns about the government's 3 percent fiscal deficit target in 2015 have increased despite proactive measures like the GST and deregulation of fuel prices. The group believes the government may need to further reduce expenditure to achieve its target.

Financial Worries

Reports that quasi sovereign wealth fund 1Malaysia Development (1MDB) missed a payment of $560 million loan due at the end of December for the second time added to Malaysia's woes.

With Prime Minister Najib Razak chairing its advisory board, the state investor firm was the latest catalyst for worries over Malaysia's financial stability. The opposition party's national publicity secretary said 1MDB's failure to repay the loan would hurt the financial health of Maybank and RHB Bank, two of the country's biggest banks and 1MDB's primary lenders, according to local media.

"Some partial good news [in this matter] is that if they are overseas assets, they can be repatriated back. It will reel in a lot more ringgit so 1MDB can pay off the ringgit denominated obligations," Vishnu Varathan, senior economist at Mizuho Bank, told CNBC.

"However, the dollar liabilities may become a huge issue so the government may be under constraint as to how to dish out the now constrained budget," he added.

The tax also led the bank to lower its 2015 inflation forecast to 2.6 percent, from 3.8 percent - significantly below the government's 3-4 percent forecast.

Moreover, Barclays notes that concerns about the government's 3 percent fiscal deficit target in 2015 have increased despite proactive measures like the GST and deregulation of fuel prices. The group believes the government may need to further reduce expenditure to achieve its target.

Financial Worries

Reports that quasi sovereign wealth fund 1Malaysia Development (1MDB) missed a payment of $560 million loan due at the end of December for the second time added to Malaysia's woes.

With Prime Minister Najib Razak chairing its advisory board, the state investor firm was the latest catalyst for worries over Malaysia's financial stability. The opposition party's national publicity secretary said 1MDB's failure to repay the loan would hurt the financial health of Maybank and RHB Bank, two of the country's biggest banks and 1MDB's primary lenders, according to local media.

"Some partial good news [in this matter] is that if they are overseas assets, they can be repatriated back. It will reel in a lot more ringgit so 1MDB can pay off the ringgit denominated obligations," Vishnu Varathan, senior economist at Mizuho Bank, told CNBC.

"However, the dollar liabilities may become a huge issue so the government may be under constraint as to how to dish out the now constrained budget," he added.

Nyshka Chandran Assistant Producer,

CNBC Asia-Pacific

Tabong Haji , IMDB dan Macam-Macam CacaMarba.

Hari nie tak mau cerita banyak, orang tak komen tapi .................cuma petikan daripada individu tertentu yang boleh di buat renungan dan kupasan sendiri..

1) Kalau TH sanggup bayar harga begitu tinggi utk tanah kepunyaan IMDB, apa alasan Kem Kewangan jualnya pd harga begitu murah kpd IMDB dulu?

Komen Netizen :

" pelik tapi benar....IMDB ni modal sejuta je. Ingat dulu boleh dpt loan sebab dia beli tanah ni hutang dgn bank, jd tanah ni adalah collateral. tp sebenarnya tanah ni free from encumbrances. maknanya !MDB beli cash dari kerajaan. mcm mana pulak modal sejuta boleh buat loan 42 billion dah boleh beli tanah dan IPP ni cash? bank bg hutang tu xdak apa2 collateral ka? mcm mana pihak maybank boleh lulus?"

"Inilah politik Malaysia bila dah berlaku baru nah heboh sebelum ni bila Rafizi tegur kat Parliment menteri semua nafi termasuk pengerusi LTH."

"siasat urus niaga bukan hukum informer"

" Its is nearly impossible to separate the arguments for investment and bailout: although the explanation given by Tabong Haji may be acceptable from a corporate perspective, said Kadir, "this must be read against the fact that in the past two months alone, almost RM3 billion has been spent to bail out IMDB from defaulting on its commitments to banks and also to meet its normal cash flow requirement"

" Org kita cepat melatah, bila melatah depa cakap tak dak facts, ikut sedap mulut saja.

"But in Mesia, based on record, 99% of rumours or melatah or mimpi or mengigau or speculation will end up to be true facts. Denial has been a good corporate game plan...and it works !"

" Another word people speculate or melatah....you hv to prove him wrong not the other way round"

"When in crisis, there's always opportunity, they have to think positively, there's a lot shit stirer in Msia"...

" The country in deep shit anyway...enjoy life while U can...naik boat, main golf, cari mempelam, mengai ikan, pi urumqi, derma apa yg boleh sek tahfiz, anak yatim, mak yatim dll"

Tu dia... hangpa pikiaq sendiri...orang kita ramai yang cerdik pandai...takat CGPA 3.85 tu kira bodoh lagi tu...

1) Kalau TH sanggup bayar harga begitu tinggi utk tanah kepunyaan IMDB, apa alasan Kem Kewangan jualnya pd harga begitu murah kpd IMDB dulu?

Komen Netizen :

" pelik tapi benar....IMDB ni modal sejuta je. Ingat dulu boleh dpt loan sebab dia beli tanah ni hutang dgn bank, jd tanah ni adalah collateral. tp sebenarnya tanah ni free from encumbrances. maknanya !MDB beli cash dari kerajaan. mcm mana pulak modal sejuta boleh buat loan 42 billion dah boleh beli tanah dan IPP ni cash? bank bg hutang tu xdak apa2 collateral ka? mcm mana pihak maybank boleh lulus?"

"Inilah politik Malaysia bila dah berlaku baru nah heboh sebelum ni bila Rafizi tegur kat Parliment menteri semua nafi termasuk pengerusi LTH."

"siasat urus niaga bukan hukum informer"

" Its is nearly impossible to separate the arguments for investment and bailout: although the explanation given by Tabong Haji may be acceptable from a corporate perspective, said Kadir, "this must be read against the fact that in the past two months alone, almost RM3 billion has been spent to bail out IMDB from defaulting on its commitments to banks and also to meet its normal cash flow requirement"

" Org kita cepat melatah, bila melatah depa cakap tak dak facts, ikut sedap mulut saja.

"But in Mesia, based on record, 99% of rumours or melatah or mimpi or mengigau or speculation will end up to be true facts. Denial has been a good corporate game plan...and it works !"

" Another word people speculate or melatah....you hv to prove him wrong not the other way round"

"When in crisis, there's always opportunity, they have to think positively, there's a lot shit stirer in Msia"...

" The country in deep shit anyway...enjoy life while U can...naik boat, main golf, cari mempelam, mengai ikan, pi urumqi, derma apa yg boleh sek tahfiz, anak yatim, mak yatim dll"

Tu dia... hangpa pikiaq sendiri...orang kita ramai yang cerdik pandai...takat CGPA 3.85 tu kira bodoh lagi tu...

Friday, May 08, 2015

ISU ISU YANG MENGELIRUKAN

Banyak isu-isu timbul baru-baru ini yang mengelirukan dan meresahkan ramai pihak...kerajaan yang memerintah turut terasa kehangatan nya.

1) Perlaksanaan GST yang dikatakan "zalim"

2) Kenyataan demi kenyataan Menteri yang mengelirukan dan menyakitkan terutama yang hangat ialah kenyataan-kenyataan Maslan, Timbalan Menteri Kewangan.

3) Hudud dan perselisihan PKR dengan PAS berkenaan isu itu

4) IMDB yang tidak terjawab

5) Syor menaikkan had umur pengeluaran EPF dari 55 kepada 60

6) Pembelian tanah IMDB oleh TH.

Banyak isu-isu itu menjadi modal pilihanraya di Rompin dan Permatang Pauh....namun begitu, parti yang sama masih menang dalam PRK tersebut walaupun majoriti mungkin kurang.

Apakah isu-isu ini tidak besar implikasi nya terhadap para pengundi dan parti yang bertanding? Adakah isu itu hanya isu yang sengaja seronok di hangatkan dan di sensasikan oleh pihak pihak tertentu tetapi tiada kesan mendalam pada masyarakat umum?

Adakah ada perkara dan benda lain yang boleh menenggelamkan isu yang begitu hangat.

Aku tak mahu nak bercerita tentang gang Myvi tu. Hari ini mereka di dakwa dan di kenakan ikat jamin sebanyak RM9000. Sikit kan walau ada nyawa yang melayang berbanding dengan model sambilan dari Sabah yang buat tayangan payudara percuma yang kena jamin RM10,000.

Bak kata orang " Lu Fikir lah Sendiri "

1) Perlaksanaan GST yang dikatakan "zalim"

2) Kenyataan demi kenyataan Menteri yang mengelirukan dan menyakitkan terutama yang hangat ialah kenyataan-kenyataan Maslan, Timbalan Menteri Kewangan.

3) Hudud dan perselisihan PKR dengan PAS berkenaan isu itu

4) IMDB yang tidak terjawab

5) Syor menaikkan had umur pengeluaran EPF dari 55 kepada 60

6) Pembelian tanah IMDB oleh TH.

Banyak isu-isu itu menjadi modal pilihanraya di Rompin dan Permatang Pauh....namun begitu, parti yang sama masih menang dalam PRK tersebut walaupun majoriti mungkin kurang.

Apakah isu-isu ini tidak besar implikasi nya terhadap para pengundi dan parti yang bertanding? Adakah isu itu hanya isu yang sengaja seronok di hangatkan dan di sensasikan oleh pihak pihak tertentu tetapi tiada kesan mendalam pada masyarakat umum?

Adakah ada perkara dan benda lain yang boleh menenggelamkan isu yang begitu hangat.

Aku tak mahu nak bercerita tentang gang Myvi tu. Hari ini mereka di dakwa dan di kenakan ikat jamin sebanyak RM9000. Sikit kan walau ada nyawa yang melayang berbanding dengan model sambilan dari Sabah yang buat tayangan payudara percuma yang kena jamin RM10,000.

Bak kata orang " Lu Fikir lah Sendiri "

Monday, May 04, 2015

FAMILIA MYVI CLUB : FMC

Di sebalik kehangatan PRK di Rompin dan Permatangan Pauh....Di sebalik panas nya isu GST dan di sebalik meriahnya Maslan dan Seberi dengan kad top-up nya....FMC mencuri tumpuan dan menjadi subjek yang meggeramkan ramai umat Netizen dan jugak membuatkan orang menyampah dengan kelab pemotoran terutama FMC atau Familia Myvi Club atau sekarang lebih dikenali dengan Fucking Murderer Club...Semua gara-gara ahlinya yang di katakan berlumba haram dan memandu secara membahaya, di suatu awal pagi, di lebuhraya DUKE KL. Yang menjadi marah nya ialah kenyataan konon nya seorang pompuan bernama Yana yang memberi kenyataan ahli nya tak berlumba, mereka di FMC ada kabel disebalik ada saksi dan rakaman CCTV yang menyatakan mereka dari FMC sebanyak 6 buah Myvi jelas berlumba....lagi marah apabila ada yang menyatakan bahawa mereka ini ada yang merupakan ahli UMNO....Yang lebih dikesalkan Tiga Nyawa Terkorban dan ada jugak posting yang di katakan dari ahli kelab ini yang mengugut untuk mencari dan membunuh saksi kejadian malah turut mengugut mereka-mereka yang mengutuk kelab FMC nie...

Ternyata ramai yang benar-benar geram dengan apa yang berlaku...Yana yang dikatakan jurucakap FMC nie memang menjadi pompuan yang paling di hina dan di benci oleh masyarakat Netizen.

Menteri Dalam Negeri memberi jaminan untuk memastikan individu yang menjadi punca kematian tiga beranak dalam kemalangan itu di hadap ke muka pengadilan. "jangan ingat ada orang dalam, individu terbabit boleh terlepas. Polis tidak akan menutup kes ini dengan mudah walaupun terdapat keterangan yang bercanggah daripada suspek dan saksi utama"

KITA TUNGGU DAN LIHAT KESUDAHAN NYA.

FMC Berjanji Bantu Dua Anak Yatim Piatu Sehingga Berusia 18 tahun : Sumber M.Star via SuriaFM

Kelab ini berdaftar kah? Adakah itu perjanjian yang antara lain mengakui bahawa ada setan-setan bertahta dalam FMC?

Komen Netizen :

1) Janji Mesti Ditepati...Ini soal kehidupan anak-anak mangsa

2) Jangansembang je...sudah

3) Boleh pcye ke admin, dgn club fmc tu.

4) Byk dana FMC . Tapi UMNO, Pemimpin / Ahli FMC pun meningkat juga..Ketua nya akan silih berganti..

Nak tengok ada penjanjian yang sah antara FMC nie...takut hangat2 tahi ayam jer!

Ternyata ramai yang benar-benar geram dengan apa yang berlaku...Yana yang dikatakan jurucakap FMC nie memang menjadi pompuan yang paling di hina dan di benci oleh masyarakat Netizen.

Menteri Dalam Negeri memberi jaminan untuk memastikan individu yang menjadi punca kematian tiga beranak dalam kemalangan itu di hadap ke muka pengadilan. "jangan ingat ada orang dalam, individu terbabit boleh terlepas. Polis tidak akan menutup kes ini dengan mudah walaupun terdapat keterangan yang bercanggah daripada suspek dan saksi utama"

KITA TUNGGU DAN LIHAT KESUDAHAN NYA.

FMC Berjanji Bantu Dua Anak Yatim Piatu Sehingga Berusia 18 tahun : Sumber M.Star via SuriaFM

Kelab ini berdaftar kah? Adakah itu perjanjian yang antara lain mengakui bahawa ada setan-setan bertahta dalam FMC?

Komen Netizen :

1) Janji Mesti Ditepati...Ini soal kehidupan anak-anak mangsa

2) Jangansembang je...sudah

3) Boleh pcye ke admin, dgn club fmc tu.

4) Byk dana FMC . Tapi UMNO, Pemimpin / Ahli FMC pun meningkat juga..Ketua nya akan silih berganti..

Nak tengok ada penjanjian yang sah antara FMC nie...takut hangat2 tahi ayam jer!

Sunday, May 03, 2015

KAD PRABAYAR.

Betui ke 2/3 pengguna kad prabayar telefon adalah warga asing? Kalu rakyat Malaysia ada sekitar 29 juta, dan jika ada kira-kira 15 juta pengguna telefon pra-bayar maka 2/3 dari itu 10 juta adalah warga asing terutama yang bekerja di Malaysia. Mengikut apa yang aku faham (sori kalu tersilap), jika ada 3 juta warga negara asing yang bekerja di Malaysia, bermakna setiap dari mereka menggunakan sekurang-kurang nya 3 no telefon dan jika setiap telefon yang mereka guna itu jenis dual sim-card, maka mereka-mereka ini menggunakan sekurang-kurang nya 2 telefon....makmur kan Malaysia!!!

Dari 15 juta pengguna kad pra-bayar ini, dan jika purata yang mereka bayar ialah RM30 sebulan, maka nilai pra-bayar ialah RM450,000,000. Banyak kosong tu....dan jika GST di kenakan atas nilai tersebut maka, kutipan GST 6% ialah RM27 juta sebulan. Setahun RM324 juta!!! Banyak tu. Itu baru dari 3 juta warga asing. Tapi heran lah kenapa Menteri kata kerajaan akan rugi RM800 juta??

Cara aku menggira mungkin tak betui kut...aku bukan nya berCGPA 3.85. Yang musykil ialah dari mana dapat nya 2/3 pengguna itu warga asing dan kenapa isu kad pra-bayar ini tidak dapat diselesaikan sebelum perlaksanaan GST dulu?

GST tak salah!! GST adalah cukai yang paling telus sebab kita pun tahu ramai yang menipu waktu buat penyata cukai untuk elak bayar atau tak mahu bayar langsung. Hal GST nie dah dimaklumkan sejak tahun lalu sebelum perlaksanaan nya pada 1hb April 2015 yang lalu. Patut nya tak adalah perkara yang berbangkit.

Ada kawan aku cakap, kad-prabayar tak perlulah GST...student banyak guna perkhidmatan telefon pra-bayar. Kalu takut atau risau warga asing yang lebih dapat manafaat nya maka pihak syarikat telco boleh menaikkan tarif atau kadar panggilan atau mesej ke luar negara. Warga asing ini tentu banyak menghabiskan nilai pra-bayar mereka untuk telefon keluarga di kampung...tapi jangan lah melebih-lebih sangat kenaikkan tu..ada hati perut lah sikit.

Lagi satu, bagi pengguna baru perkhidmatan pra-bayar, apabila mereka mendaftar, kenakanlah caj pendaftaran...terutama untuk warga asing.

Ok...biar menteri SKMM, KDRM, Maslan dan Telco fikirkan hal nie....

Dari 15 juta pengguna kad pra-bayar ini, dan jika purata yang mereka bayar ialah RM30 sebulan, maka nilai pra-bayar ialah RM450,000,000. Banyak kosong tu....dan jika GST di kenakan atas nilai tersebut maka, kutipan GST 6% ialah RM27 juta sebulan. Setahun RM324 juta!!! Banyak tu. Itu baru dari 3 juta warga asing. Tapi heran lah kenapa Menteri kata kerajaan akan rugi RM800 juta??

Cara aku menggira mungkin tak betui kut...aku bukan nya berCGPA 3.85. Yang musykil ialah dari mana dapat nya 2/3 pengguna itu warga asing dan kenapa isu kad pra-bayar ini tidak dapat diselesaikan sebelum perlaksanaan GST dulu?

GST tak salah!! GST adalah cukai yang paling telus sebab kita pun tahu ramai yang menipu waktu buat penyata cukai untuk elak bayar atau tak mahu bayar langsung. Hal GST nie dah dimaklumkan sejak tahun lalu sebelum perlaksanaan nya pada 1hb April 2015 yang lalu. Patut nya tak adalah perkara yang berbangkit.

Ada kawan aku cakap, kad-prabayar tak perlulah GST...student banyak guna perkhidmatan telefon pra-bayar. Kalu takut atau risau warga asing yang lebih dapat manafaat nya maka pihak syarikat telco boleh menaikkan tarif atau kadar panggilan atau mesej ke luar negara. Warga asing ini tentu banyak menghabiskan nilai pra-bayar mereka untuk telefon keluarga di kampung...tapi jangan lah melebih-lebih sangat kenaikkan tu..ada hati perut lah sikit.

Lagi satu, bagi pengguna baru perkhidmatan pra-bayar, apabila mereka mendaftar, kenakanlah caj pendaftaran...terutama untuk warga asing.

Ok...biar menteri SKMM, KDRM, Maslan dan Telco fikirkan hal nie....

Saturday, May 02, 2015

What Happens If EPF Raises The Withdrawal Age?

A Good Article: Credit to https://www.imoney.my/.../what-happens-if-epf-raises-the-withdrawal-ag..

Many Malaysians look forward to enjoying their fruits of labour in their golden years, so it is hardly surprising that a proposal by the Employee’s Provident Fund (EPF) to raise the permissible age for members to withdraw their retirement savings from 55 years currently to 60 years was met with a flurry of objections.

While Malaysia’s minimum retirement age for the private sector has been set at 60 since July 2013, many individuals are rejecting the idea of raising the EPF full withdrawal age to the same age, likening it to an infringement of contributors’ rights to their hard-earned money.

However, many of these strong and hard responses do not take into account EPF’s statistics that suggest that the majority of its contributors prematurely run out of savings post-retirement.

According to EPF, almost 70% of its members had less than RM50,000 upon retirement. Going by this baseline, even if they made do with just RM800 a month (which is below the minimum wage in Peninsular Malaysia), the amount will be wiped out in five years, with the average life expectancy in Malaysia at 75 years.

EPF has worked out that a member will need at least RM196,800 in basic savings in order to be able to survive on a monthly income of RM820 for another 20 years. This is being super conservation, because everyone should aim to have enough to maintain their standard of living post-employment.

EPF claims that by raising the age requirements, members stand to gain greater financial security and sustainability. We take a look at the pros and cons that might follow if the proposal comes into effect:

Under Malaysian law, employees (11%) and their employers (12%) are required to make monthly contributions from their income into the employees’ respective EPF account.

These monthly contributions are in turn invested in a number of approved financial instruments to generate income. They include Malaysian Government securities, money market instruments, loans and bonds, equity and property.

Dividends generated from these investments are paid annually into your account. While dividend rates declared by the EPF is depending on investment results and can vary from year-to-year, it guarantees a minimum of 2.5% dividend per annum.

The good news is, EPF has shown a yearly dividend return of over 6% on average in the last five years:

The move to raise the EPF withdrawal age to 60 will give members the

advantage of making consistent returns for longer, as well as eliminates

the risk of negative returns (you can’t make losses with EPF). This is

especially beneficial for those with little or no prior investing

knowledge.

2. It gives you compounded dividends

As shown above, EPF offers compounded dividends, meaning that the interest you earn each year is added to your principle. The result is that your balance does not merely grow, it grows at an increasing rate.

Let’s assume that you have RM50,000 in your EPF account at the current age of retirement of 55. If the proposal to raise the full EPF withdrawal age to 60 comes into effect, your EPF savings will increase by about 33.8% or RM16,911in five years, with the average interest of 6% per annum.

Further, EPF dividends outstrip potential returns from other investment options such as savings and fixed deposit accounts. The highest fixed deposit interest rate currently offered in Malaysia is 4.28% compared to EPF’s average return of 6% per annum.

3. You reduce the risk of running out of money sooner